You have most likely seen the headlines play out over the last couple of years about the failed crypto exchange, FTX, that went up in flames in spectacular style, resulting in its founder and co-CEO, Sam Bankman-Fried, being jailed for 25 years, along with other executives for losing $8B. It is fair to say that not a lot of people truly understood what went down, and I was one of those.

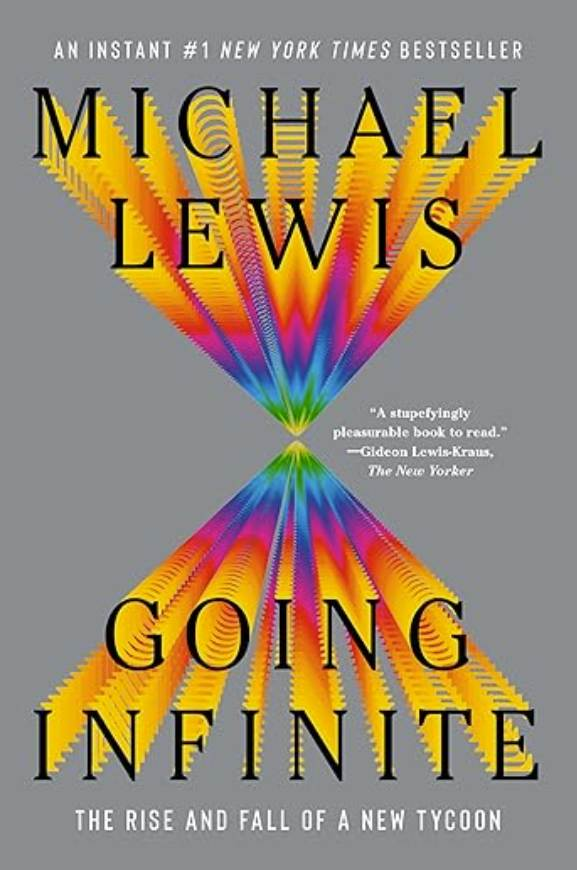

So when I heard Michael Lewis (he of Moneyball) talking about his book on a podcast, and how he spent significant one-on-one time with Sam, I thought – ooh this will lift the lid on the whole thing and I will be suitably informed.

Cutting to the chase – after completing the book, I am still no further forward to what actually happened. Talk about a cliffhanger. In all fairness, he calls this out at the end, and when he sat down and talked to Sam about it, he isn’t really sure what happened either – all we know for certain is that in a space of a single weekend, billions were lost (both real US dollars and crypto) – and he maintains that FTX and Alameda Research were liquid.

Setting the non-conclusion aside, this Lewis does a wonderful job of narrating his ringside seat throughout all of this. He had direct access to everyone, and no one seemed to hold back – open and honest. An attempt is made to try and understand the enigma that Sam was, from all parties, and no one really could put their finger on it.

They have often been referred to as a cult (since most of the C-levels shared an actual house together – and Caroline was sleeping on and off with Sam), but that would be too easy and dismissive. They all shared an altruistic dream, and my analysis is: you have a bunch of young adults who were extremely good at making extremely large sums of money in financial trading and wanted to make the world a better place. Naive is the word that I keep coming back to, and they were very trusting of those around them.

Their customers didn’t really care for their WHY; they were happy to continue to reap the rewards of the crypto space without having to understand any of it.

The book is filled with so many bizarre stories, brushes with celebrity, international trading regulations, and a lifestyle where money was simply not a barrier to entry to anything. They were a healthy business, making genuine commission money on trades and had no need to do anything shady. Naivety again raises its head—corporate checks and balances were not in place.

It is well worth the read, and my only real critique is that it was published too soon as the story is still playing out. We have money being returned, executives having their sentences reduced, and appeals in situ—more to come.

Warning: it will leave you wanting more.